Today's economic environment can be complex and ever-changing. With numerous financial products and investment options available, discovering the right financial advisor becomes for achieving your wealth goals.

Choosing a competent and trustworthy financial advisor may seem daunting, but by following these guidelines, you can navigate the process and begin on your journey to financial prosperity.

First, clearly define your retirement goals. What are you hoping to achieve with the help of a financial advisor? Do you want to grow for retirement, purchase a home, or fund your children's education?

After you have a precise understanding of your retirement goals, it's time to investigate different financial advisors. Examine for advisors who are licensed and have expertise in the areas that are most relevant to you.

Don't hesitate to inquire for testimonials from friends, family, or colleagues who have positively worked with financial advisors in the past.

Discover Your Potential with Expert Financial Guidance

Are you looking to|aspiring financial freedom? Expert financial guidance can be the key to achieving your full capabilities. Investment specialists provide personalized strategies that help you navigate the complexities of personal finance. From planning a budget to expanding your wealth, expert advice can set you on the path to a more confident financial future. Don't hesitate any longer to take advantage of the benefits of professional financial guidance.

Master Your Finances on Pinterest!

Ready to maximize your financial well-being? Follow my savvy advisers on Pinterest for brilliant money moves that actually work.

We'll share hacks on spending, building wealth, and achieving your money goals.

Follow our community of money-smart individuals and let's your journey to wealth success!

Secure an Unsecured Business Loan & Propel Your Growth

Unsecured business loans present a vital funding option for entrepreneurs seeking to grow their ventures. Unlike secured loans, which require collateral, unsecured loans rely on your business's creditworthiness and operational history.

Obtaining an unsecured loan can empower you to achieve your goals, Apply for Free Credit Card whether it's spending in technology, expanding your team, or settling cash flow expenses.

By harnessing an unsecured loan, you can fast-track your business growth and position yourself for long-term success.

Instant Personal Loans: Get The Funds You Need, Now!

Need some cash injection to cover unexpected expenses or make a purchase? Our instant personal loans provide you the capital you need, without hassle. With our easy online application, you can be approved for a loan amount in as little as 24 hours.

- {Get cashfor any purpose you need!

- {Competitive interest rates and flexible repayment terms to fit your budget.

- Apply online from the comfort of your own home in minutes.

Don't wait any longer! Apply today and see how an instant personal loan can get you back on track.

Achieve Financial Freedom Starts Here: Connect with Top Advisors

Are you hoping of a future where financial worries are a thing of the past? Where you have the flexibility to pursue your passions and live life on your own terms? True freedom is within reach, but it takes a strategic plan and expert guidance.

Connecting with top financial advisors is the essential step towards achieving your financial goals. These skilled professionals can help you understand the complexities of investing, planning for retirement, and optimizing your assets.

- Through personalized financial plans, advisors can help you pinpoint areas for improvement and create a roadmap to prosperity.

- These specialists provide ongoing support and direction, adjusting your strategy as needed to accommodate changes in your life and the market.

- Never waiting any longer to take control of your financial future.

Take the first step towards financial freedom today by connecting with a top advisor. Your future self will appreciate you did.

Tony Danza Then & Now!

Tony Danza Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Danica McKellar Then & Now!

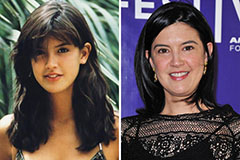

Danica McKellar Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!